August’s housing data shows cooling sales but steady contracts and pricing strength. For inspectors, the overall picture points to consistent demand this year and a stronger 2026 ahead.

Sales and inventory

- Existing home sales totaled 376,000 in August, down –3.3% from July and –0.8% YoY

- Year-to-date sales are down –1.2% (with July revised by +1,000)

- Inventory held at 1.53 million homes, flat month-over-month but up +9.5% YoY

- Months’ supply stayed at 4.6, signaling balanced but cooling conditions.

Contracts and pricing

- HouseCanary reports 296,630 homes went under contract, up +10.7% YoY

- Price cuts surged +22% YoY, the largest increase since 2020

- The national median existing home price hit $422,600, a +2.0% YoY gain

- Regional performance was mixed: Midwest (+4.5%) and Northeast (+6.2%) led, while the West was nearly flat (+0.6%)

- Median closed price rose +3.0% YoY to $442,427

Mortgage rates

- Mortgage rates averaged 6.8% in Q3

- Rates dipped to 6.17% in September, then climbed to 6.34% following the Fed’s rate cut

- Forecasts call for rates to gradually ease toward 6.5-6.4% by early 2026

Current forecasts

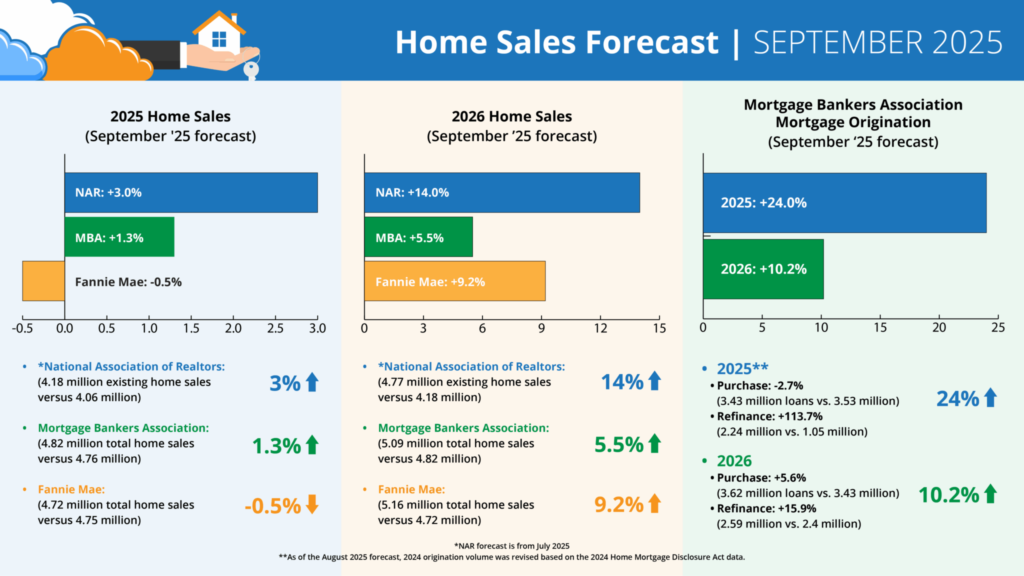

Forecasts for 2025 Home Sales (September’25 forecast)

- *NAR: +3.0% (4.18 million existing home sales vs. 4.06 million)

- MBA: +1.3% (4.82 million total home sales vs. 4.76 million)

- Fannie: -0.5% (4.72 million total home sales vs. 4.75 million)

Forecasts for 2026 Home Sales (September’25 forecast)

- *NAR: +14.0% (4.77 million existing home sales vs. 4.18 million)

- MBA: +5.5% (5.09 million total home sales vs. 4.82 million)

- Fannie: +9.2% (5.16 million total home sales vs. 4.72 million)

MBA Forecast for Mortgage Originations (September’25 forecast)

- 2025** Total Mortgage Originations: +24.0% (5.67 million loans vs. 4.57 million)

- Purchase: -2.7% (3.43 million loans vs. 3.53 million)

- Refi: +113.7% (2.24 million vs. 1.05 million)

- 2026 Total Mortgage Originations: +10.2% (6.24 million loans vs. 5.67 million)

- Purchase: +5.6% (3.62 million loans vs. 3.43 million)

- Refi: +15.9% (2.59 million vs. 2.4 million)

* NAR forecast is from July 2025

What this means for inspectors

For HIP inspectors, steady contract activity and higher inventory show that demand for inspections isn’t dropping off. Even as closed sales slow, motivated sellers are adjusting prices and buyers are still signing contracts. That means inspections will continue to play a key role in getting deals across the finish line.

And with 2026 forecasts from NAR, MBA, and Fannie Mae all projecting growth, the work you do now to strengthen agent relationships and streamline your reports sets you up for more business as the market rebounds.