The housing market continues to shift, and if you’re planning for growth and expanding your services, it’s worth paying attention to what the latest numbers reveal.

In June, we saw signs of increased buyer activity and improving inventory levels, which could be a positive signal for inspectors across the country. While challenges like affordability and interest rates haven’t gone away, data from the National Association of Realtors, the Mortgage Bankers Association, Fannie Mae, and HouseCanary suggest the market is showing signs of life.

Here’s a quick look at what’s happening and what it could mean for your inspection business.

May 2025 market data: A look back

- Existing home sales (not seasonally adjusted): 389,900 homes sold – up +11.5% month-over-month, though still –4% year-over-year

- Year-to-date sales: -2.8% below the same period in 2024, but the gap is narrowing

- Inventory: 1.54 million homes – a +6.2% increase from April and the highest level since 2020

- Months of supply: Rose to 4.6, giving buyers more options and potentially more opportunities for inspectors

- Closed sale prices: Up +1.9%, while price cuts increased +34.7%, signaling sellers adjusting expectations

Forecasts for 2025-2026

HouseCanary reports:

- Inventory is up +22.9% year-over-year

- Contract volume is up +5.8% year-over-year

National median home price:

- Reached $422,800 (+1.3% YoY), with stronger gains in the Midwest (+3.4%) and Northeast (+7.1%)

Mortgage rates:

- Averaged 6.8% in June, with forecasts pointing toward a gradual decline to around 6.5% by year-end

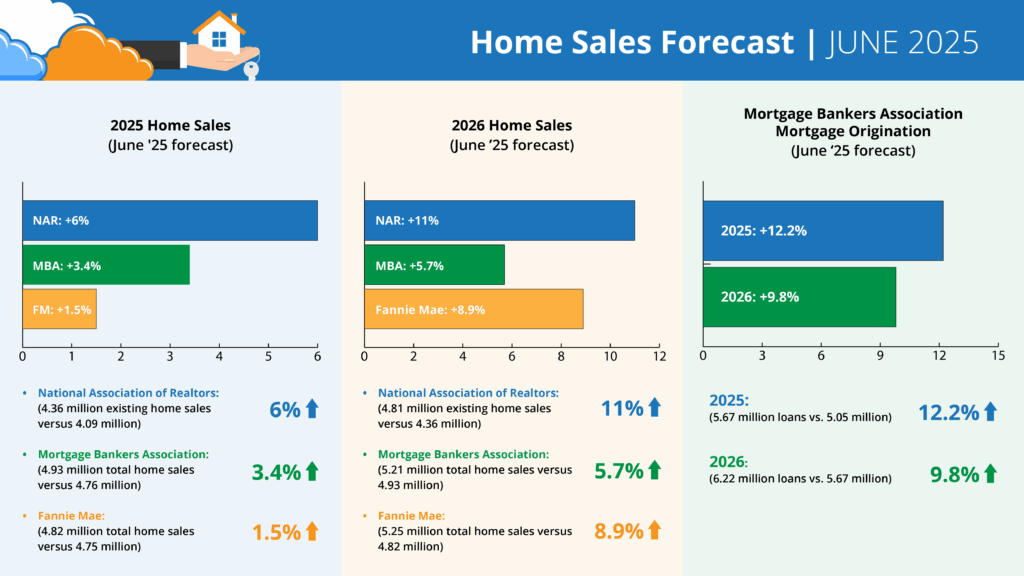

Forecast snapshot: 2025-2026 sales and mortgage outlook

2025 home sales forecasts (June 2025)

- NAR: +6% growth to 4.36 million existing home sales (up from 4.09 million in 2024)

- MBA: +3.4% growth to 4.93 million total home sales (up from 4.76 million)

- Fannie Mae: +1.5% growth to 4.82 million total home sales (up from 4.75 million)

2026 home sales forecasts (June 2025):

- NAR: +11% growth to 4.81 million existing home sales (up from 4.36 million)

- MBA: +5.7% growth to 5.21 million total home sales (up from 4.93 million)

- Fannie Mae: +8.9% growth to 5.25 million total home sales (up from 4.82 million)

Latest MBA mortgage originations forecast (June 2025)

2025 total mortgage originations: +12.2% growth to 5.67 million loans (up from 5.05 million)

- Purchase: +2.4% growth to 3.44 million loans (up from 3.36 million)

- Refinance: +31.8% growth to 2.23 million loans (up from 1.69 million)

2026 total mortgage originations: +9.8% growth to 6.22 million loans (up from 5.67 million)

- Purchase: +5.9% growth to 3.64 million loans (up from 3.44 million)

- Refinance: +15.8% growth to 2.58 million loans (up from 2.23 million)

What this means for inspectors

For growing inspection businesses, the data could signal opportunity. Rising inventory may mean more homes on the market, which could translate to increased inspection volume.

While year-over-year sales are still slightly down, month-over-month gains and more active listings point to a market gaining traction. If your schedule is already filling up or you’re gearing up to scale, now’s the time to ensure your systems are ready to handle the volume.

With tools like HIP’s robust report writer, embedded media, and real-time sharing, plus HIP Office’s automation for scheduling, agreements, and payments, inspectors can handle more jobs without taking on more admin.

Stay tuned – HIP will continue to keep you updated with the latest market insights so you can plan ahead, stay efficient, and keep growing.