December wrapped up 2025 with a bump in activity, and early forecasts suggest 2026 could bring moderate growth.

Existing home sales for December 2025 totaled 345,000 (non-seasonally adjusted), up +16.9% from November and +4.9% year over year, according to the National Association of Realtors (NAR). Even with that increase, total 2025 sales finished flat at 4,061,000 compared to 4,062,000 in 2024.

Inventory remains constrained. At the end of December, 1.18 million homes were on the market, down -18.1% from November, but +3.5% higher than a year ago, according to Zillow. Supply tightened month over month, though it has improved slightly on an annual basis.

Home prices are steady nationally, with some regional variations. NAR reported a +0.4% YoY increase in December to $405,400. The Northeast and Midwest saw price gains above +3%, while the West declined -1.4%.

The Mortgage Bankers Association (MBA) MBA reported the national median existing home price at $409,200, up +1.2% YoY. The Midwest led at +5.8%, followed by the Northeast (+1.1%), the South (+0.8%), and the West (-0.9%).

Mortgage rates ended 2025 at 6.2%, according to MBA and Fannie Mae. Fannie projects rates easing to 6.0% by mid-2026 and holding there through 2027. MBA expects the 30-year fixed rate to remain between 6.1% and 6.3%.

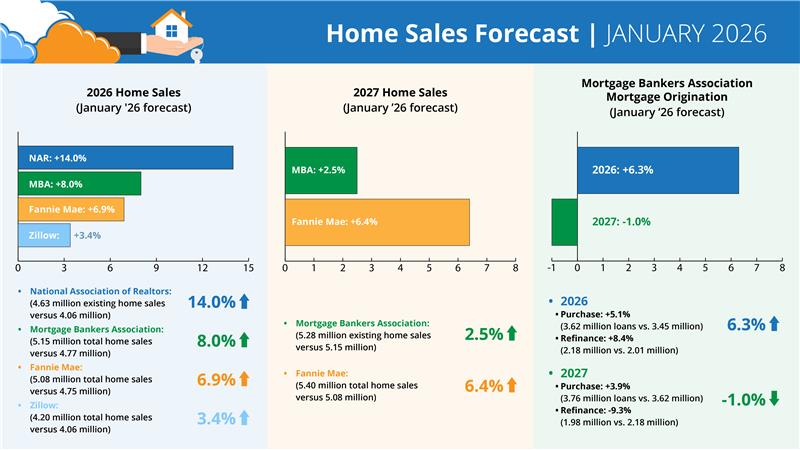

2026 and 2027 outlook

January 2026 projections show expected sales growth next year:

- NAR: +14.0% (4.63 million existing home sales vs. 4.06 million)

- MBA: +8.0% (5.15 million total home sales vs. 4.77 million)

- Fannie Mae: +6.9% (5.08 million total home sales vs. 4.75 million)

- Zillow: +3.4% (4.20 million existing home sales vs. 4.06 million)

For 2027:

- MBA: +2.5% (5.28 million vs. 5.15 million)

- Fannie Mae: +6.4% (5.40 million vs. 5.08 million)

Mortgage originations

MBA’s January forecast projects:

2026 total mortgage originations: +6.3% (5.80 million loans vs. 5.46 million)

- Purchase: +5.1% (3.62 million vs. 3.45 million)

- Refi: +8.4% (2.18 million vs. 2.01 million)

2027 total mortgage originations: -1.0% (5.74 million vs. 5.80 million)

- Purchase: +3.9% (3.76 million vs. 3.62 million)

- Refi: -9.3% (1.98 million vs. 2.18 million)