A quieter November, but not a stalled market

According to the National Association of Realtors (NAR), existing home sales totaled 293,000 (non-seasonally adjusted) in November, down -18.4% month over month and -7.0% year over year. Year-to-date sales are now down -0.5% compared to 2024.

At the same time, buyer activity held up. Data from HouseCanary shows net new listings declined -16.2% YoY, while homes under contract rose +10.1% YoY. Fewer homes are available, but buyers are still acting when they find one.

Prices remain stable

According to HouseCanary, median listing prices dipped slightly (-0.3% YoY), while median closed prices increased +3.4%. The national median home price rose to $409,200, a +1.2% YoY gain, based on data from the Mortgage Bankers Association (MBA).

Regional movement was limited, with the Midwest leading at +5.8% and other regions staying mostly flat.

Mortgage rates and longer-term outlook

The MBA reports mortgage rates averaged 6.6% in Q3 2025. Forecasts from Fannie Mae call for modest easing into 2026, while longer-term expectations keep rates in the low-to-mid 6% range.

Current forecasts

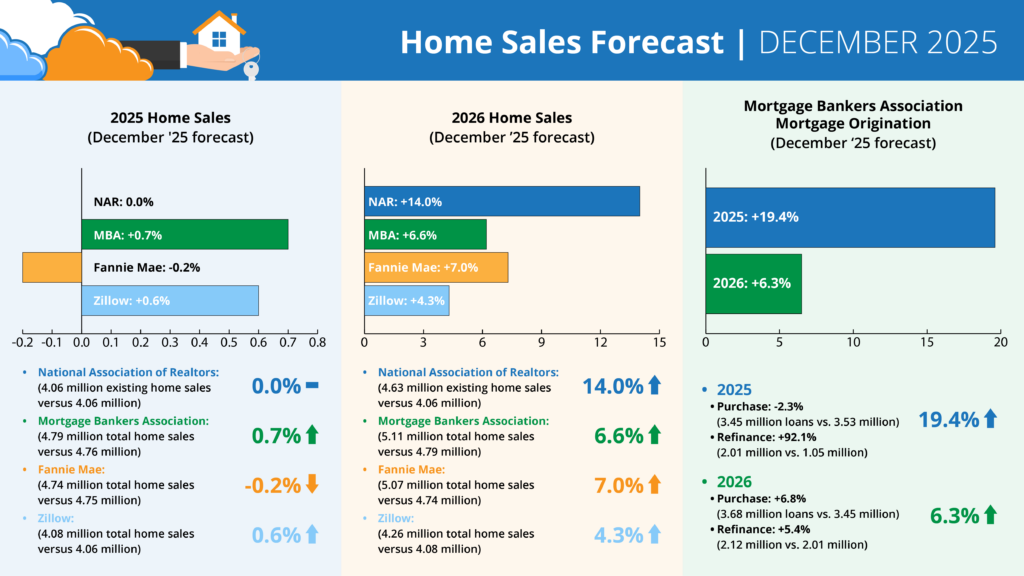

Forecasts for 2025 home sales (December ‘25 forecast)

- NAR: 0.0% (4.06 million existing home sales vs. 4.06 million)

- MBA: +0.7% (4.79 million total home sales vs. 4.76 million)

- Fannie Mae: -0.2% (4.74 million total home sales vs. 4.75 million)

- Zillow: +0.6% (4.08 million existing home sales vs. 4.06 million)

Forecasts for 2026 home sales (December ‘25 forecast)

- NAR: +14.0% (4.63 million existing home sales vs. 4.06 million)

- MBA: +6.6% (5.11 million total home sales vs. 4.79 million)

- Fannie Mae: +7.0% (5.07 million total home sales vs. 4.74 million)

- Zillow: +4.3% (4.26 million existing home sales vs. 4.08 million)

MBA forecast for mortgage originations (December ‘25 forecast)

2025 total mortgage originations: +19.4% (5.46 million loans vs. 4.57 million)

- Purchase: -2.3% (3.45 million loans vs. 3.53 million)

- Refi: +92.1% (2.01 million vs. 1.05 million)

2026 total mortgage originations: +6.3% (5.80 million loans vs. 5.46 million)

- Purchase: +6.8% (3.68 million loans vs. 3.45 million)

- Refi: +5.4% (2.12 million vs. 2.01 million)

What it means for inspectors

For independent inspectors, November reinforces the importance of staying efficient during slower stretches. Inspections remain necessary for active buyers, even when inventory is tight.

With higher transaction volume projected for 2026, steady operations now help inspectors stay prepared as conditions improve.