The housing market may be shifting.

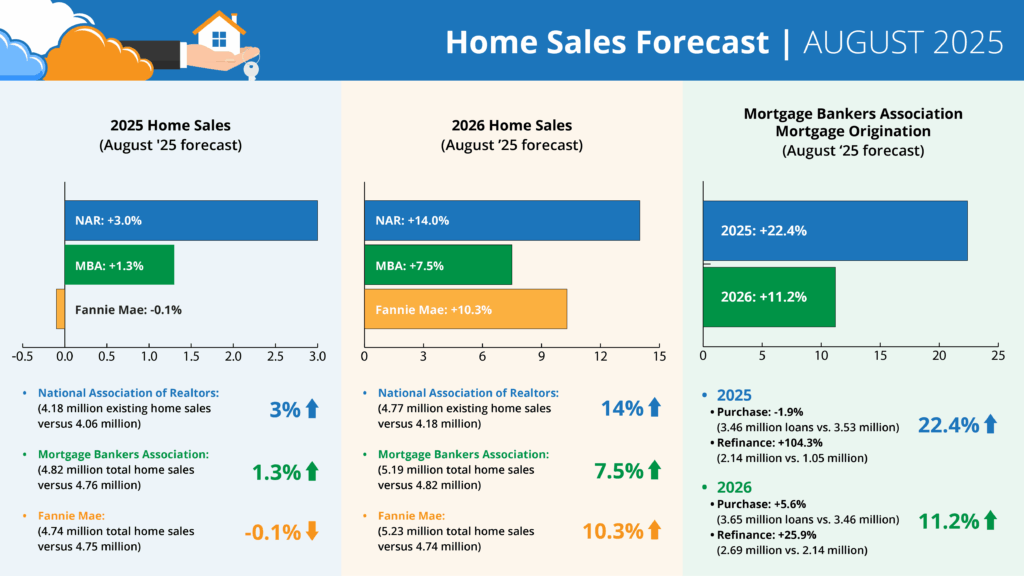

Fannie Mae called for a contraction (-0.1%) in 2025 sales in August. At the same time, the average forecast has slipped from an +11.8% growth outlook in January 2024 to just +1.4% growth in August.

For inspection businesses looking to grow, cooling forecasts highlight the need to stay efficient and ready for opportunities even if the pace of sales slows.

August highlights for July data

- Existing home sales for July 2025 totaled 388,000 (non-seasonally adjusted), -0.8% from June and -0.5% YoY. Year-to-date existing home sales are down -1.3%.

- Inventory rose to 1.55 million homes from 1.53 million and +15.7% year-over-year.

- HouseCanary reports a +7.7% increase in contract volume. Closed prices increased +3.4% while price cuts increased +25.7%.

- The national median existing home price increased to $422,400, a +0.2% YoY gain, with the Midwest (+3.9%) and West (-1.4%) as the largest changes.

- Mortgage rates averaged 6.8% in June, with expectations for a slight decline to around 6.6% by year-end, according to the Mortgage Bankers Association (MBA).

Current forecasts

Forecasts for 2025 home sales (August ’25 forecast)

- NAR: +3% (4.18 million existing home sales vs. 4.06 million)

- MBA: +1.3% (4.82 million total home sales vs. 4.76 million)

- Fannie: -0.1% (4.74 million total home sales vs. 4.75 million)

Forecasts for 2026 home sales (August ’25 forecast)

- NAR: +14% (4.77 million existing home sales vs. 4.18 million)

- MBA: +7.5% (5.19 million total home sales vs. 4.82 million)

- Fannie: +10.3% (5.23 million total home sales vs. 4.74 million)

MBA forecast for mortgage originations (August ’25 forecast)

- 2025 Total Mortgage Originations: +22.4% (5.6 million loans vs. 4.57 million)

- Purchase: -1.9% (3.46 million loans vs. 3.53 million)

- Refi: +104.3% (2.14 million vs. 1.05 million)

- 2026 Total Mortgage Originations: +11.2% (6.22 million loans vs. 5.6 million)

- Purchase: +5.6% (3.65 million loans vs. 3.46 million)

- Refi: +25.9% (2.69 million vs. 2.14 million)

Key insights for inspectors

For inspection businesses looking to grow, this mix of rising inventory (+15.7%) and slower sales (-0.8% from June to July, -0.5% YoY in July) points to both challenge and opportunity.

More homes on the market means more potential clients, but competition will be tighter. Inspectors who can deliver reports quickly and manage their workload efficiently will be best positioned to capture business as the market shifts.